Use OAuth APIs everywhere they are available (Chase, Bank of America, etc.)

Comments

-

Truist holds my mortgage. Every time I opened Simplifi I’d get a request for MFA for Truist. After a while I just deleted the account from. Simplifi. Tried it again and yesterday and it does the same thing. Truist is not on the list posted above of banks that use OAuth. Does that mean that this situation will not be resolved in the foreseeable future?

I wouldn’t mind so much if Simplifi had a decent way to track mortgage payments. As it stands now mortgage payments need to be manually entered every month to get the P&I numbers correct and to have all the pieces of the transaction (e.g., escrow) recorded properly as splits in a single transaction instead of as separate transactions.

I do like Simplifi overall but some of its quirks are real head scratchers.

0 -

American Express is on the OAuth list but still is not using OAuth connection when adding a credit card account. It does not bring you to the Amex login page but an internal Finicity one like most other accounts. I confirmed this when I changed my password and my connection broke which would not happen with OAuth. I think I have an elevated ticket with support (no way to really know or track that which is annoying) but haven't heard anything in weeks.

0 -

I was told that I am on a different set of servers or something and that the set I am on does not have OAuth for Amex. Can I ask why some people would have access to OAuth and some wouldn't in a cloud application? I also asked if I could be switched to the other set of servers so I could access that functionality and was told I could not. Pretty frustrating seeing how seamless OAuth is for some other accounts and other people but I can't access it.

0 -

When they added plaid support, they did it in a way that existing users stayed with the intuit connectors, and some new accounts were set up with plaid options. If it were possible to switch you, they might have to delete your dataset and start fresh.

—

Rob Wilkens

0 -

Please work on supporting E*Trade Oauth.

0 -

American Express will soon be migrating Savings and Loan Accounts to OAuth!

-Coach Natalie

-Coach Natalie

2 -

But you don't currently support password+token MFA options for E*Trade by Morgan Stanley accounts which is a security risk.

Please OAuth or other applicable standard so that we can link E*Trade saving/checking accounts while keeping 2FA enabled.

It appears the bank supports it.

https://developer.etrade.com/getting-started/developer-guides

2 -

It appears that Ally is offering an API with OAuth:

Get Started | Ally Developer Portal

Please try to add Ally support.

1 -

Chime is expected to migrate to OAuth starting next week!

-Coach Natalie

1 -

Is Ally Bank on the list for OAuth implementation? I see that some smaller banks are already in progress. I know Ally is not the largest bank out there, but from some very quick Googling, it looks like they're ranked 21st in the US in terms of assets, and they are always a solid choice for a high-yield online savings account, which I think many Simplifi users would be interested in utilizing if only for something like savings goals.

1 -

American Express still does not allow OAuth on whichever server my data is on. Discover is also not on the list even though they are one of the 4 credit card networks and a top 10 credit card company.

1 -

Vanguard will be migrating very soon!

-Coach Natalie

2 -

Cool. I am looking forward to Vanguard.

But why do these seem to be "one-offs" instead of a "standard"? That is, all institutions would implement this in a standard way and it would just work automatically with Simplifi?

1 -

Pentagon Federal Credit Union is migrating next!

-Coach Natalie

2 -

Empower is expected to start migration next week!

-Coach Natalie

0 -

@Coach Natalie What does this mean? No more only getting updates midnight until 7am? :-)

0 -

-

Got an e-mail saying citibank is "coming in the next 30 days" too. It's not clear if that was Quicken Classic, Simplifi, or both.

—

Rob Wilkens

0 -

Hello @RobWilk,

So far, it's been announced that branded credit cards serviced by Citibank will migrate to the new connection method in Quicken Classic for Windows and Quicken Classic for Mac. We haven't yet received confirmation whether it will impact Quicken Simplifi.

I hope this helps!

-Coach Kristina

1 -

Starting next week, Citi retail cards (such as Best Buy, Macy's, Shell Mastercard, etc.) will begin migrating to OAuth!

-Coach Natalie

2 -

The next migrations will be Coinbase, Rocket Mortgage, and Rutter.

Thanks!

-Coach Natalie

1 -

Just like to follow up on previous comments… American Express was finally enabled for OAuth on the Intuit-based servers and I was able to connect that way. Hoping for Discover credit cards and banking soon.

2 -

@Coach Natalie I have asked FourLeaf Federal Credit Union to work wiith Quicken to add OAUTH support - if Quicken needs to do something to work with them, please do

The main issue is the password managers confuse differnt passwords/accounts on which are entered on the same domain.

—

Rob Wilkens

0 -

In your post above from May 2023, you pointed to this article for a list of the banks that support OAuth with Simplifi:

That article hasn't been updated in many months. Is there an updated list somewhere? I'm specifically interested in whether there Key Bank supports OAuth. Thanks.

0 -

@SeattleGuy, thanks for reaching out!

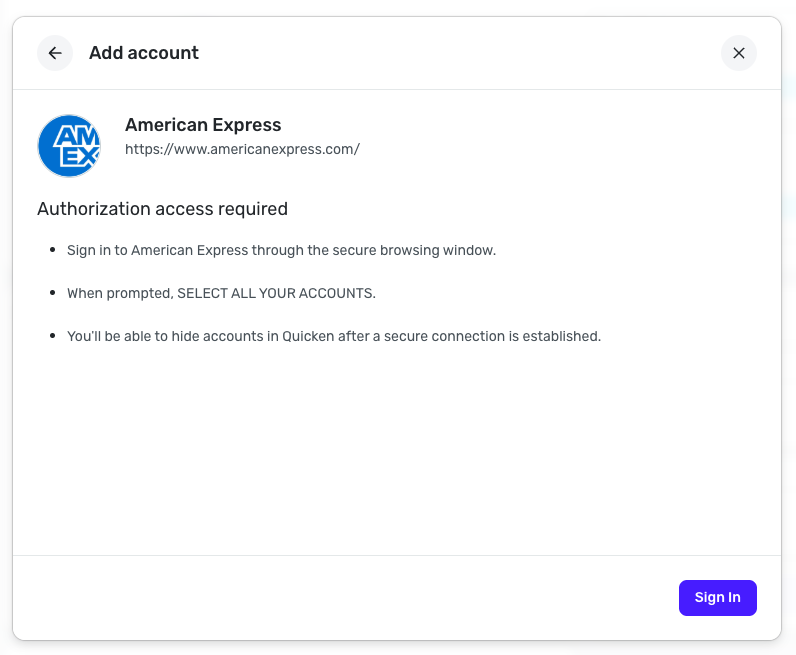

I don't see that the list of OAuth API banks is available in that support article anymore, so it was likely removed by our content team. The best way to determine if a bank is on OAuth in Quicken Simplifi is to try to connect to it and see if you get the "Authorization access required" screen, such as this one for American Express —

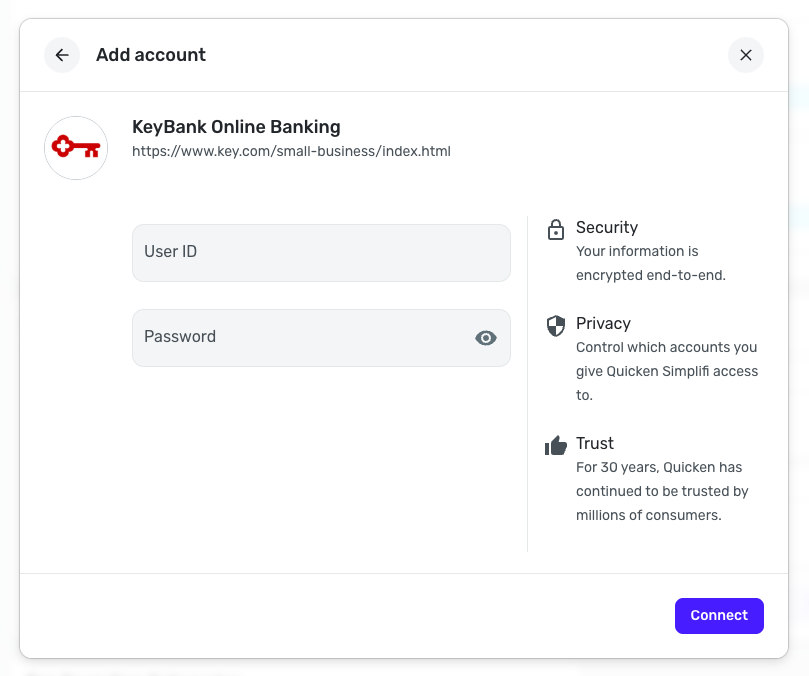

With that, it does not appear that KeyBank Online Banking is on an OAuth API connection —

I hope this helps answer your question!

-Coach Natalie

0 -

@Coach Natalie It does answer my question, thanks!

1 -

Discover and Voya will be migrating to OAuth next!

-Coach Natalie

1 -

Citizens Bank is currently migrating to OAuth!

-Coach Natalie

0