Split transactions should be treated as separate transactions (2 Merged Votes)

Comments

-

I have the same question and for that reason, I agree to splitting most details (tags, category, notes, link to recurring..) but not dates.

I think the reason it comes up is because people want to fit transactions into the spending plan for specific months when it doesn't always work out that way. For example, if you pay someone every month but in April you pay them on the 30th so you just give them double to cover May as well. So then you'd want to split the transaction into 2 parts, April 30, and May 1, so that it would fit neatly into the monthly spending plan buckets.

I thought rollover would help with this but it's not so clear cut if it does or not, especially since rolling over doesn't help with surplus funds (or a deficit) from month to month.

0 -

A more typical way of handling this would be to book the payment (or part of it) as "Prepaid Expense."

For example, let's say you make a $600 payment for 6 months of insurance coverage. In this scheme, you would need an expense category for "Insurance" and an asset account for "Prepaid Expenses."

When you make the payment, you split it $100 to Insurance and $500 to Prepaid Expenses — both occurring on the same date. Then you set up a recurring payment of $100/month for Insurance to be paid out of the Prepaid Expenses account on future dates. Splits with different dates are not required.

With this method, the entire $600 comes out of your bank account on the date paid, but the expenses show up in the future at the rate of $100 per month. The downside is that you have a $500 asset in Prepaid Expenses that doesn't exist in the real world. (Or maybe it does if the insurance is refundable.)

This also seems like a lot of trouble and a source of possible user error.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

Agreed. So many reasons to have this feature. Almost no reasons not to. Those who say "I don't get why this is needed" just wouldn't have to use it. I hope they listen to us...

1 -

You'd need to (pretend to) pay the remaining expense, the next month, from the fake/manual account. That way the expense would be listed in the correct month and the money would be transferred out of the fake account.

I've done this sort of thing to transfer income surplus from one month to the next. It works but it's a bunch of steps and a little clumsy and you have to make sure you got it right.

0 -

@EL1234 "You'd need to (pretend to) pay the remaining expense, the next month, from the fake/manual account."

Right. That's what I tried to describe in the example I set up:

"Then you set up a recurring payment of $100/month for Insurance to be paid out of the Prepaid Expenses account on future dates."

Sorry if that wasn't clear.

And I agree that it's clumsy. It's something a bookkeeper might do. But it's more than I want to do.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

I see what you mean! I wouldn't set a recurring expense because you'll still need to create the actual transactions manually. So they'd be recurring if you set them each up.

I did it a few times with income but lately I haven't been using the spending plan because the data needed too much massaging in order to be useful. I hope to get back to it at some point.

0 -

I agree about the "data massaging" burden, and I try to avoid it.

I personally use the Spending Plan a lot, but in order to do so I've had to just accept it for what it is. Rather than trying to make it exactly reflect the ebb and flow in the real world, I just use it for what it can do "as is."

It keeps me up to date on how my money is being spent (or obligated), and that's really what I need.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

I agree with making the split transaction 2 separate transactions with a link on the backend. The combined transaction and the way it exports in the CSV is making the data unusable in excel. I spend way too much time manipulating the exported data to ensure my pivot tables are showing me all relevant data. The simplifi development team needs to fix this issue….I can't say i really care about how but the export needs to be seamless😊

0 -

Will this ever get fixed?

0 -

This feature would be good only if there is an option to set the display mode in the register as separate or combined. I understand the benefit for exporting and allowing notes for each split is a big request for me. But when reviewing my transactions and comparing to my bank, it is difficult if displayed separately in the register as I am looking for the total value. I tried Monarch and this was the primary reason I did not keep it.

It is actually not the best way to handle the issue. Most likely on their backend database they have a transaction table and a splits table. So instead of creating two transactions, really the request is can you add those fields which you want to be unique to the split, to the splits table whereas today they are only in the transaction table. Then exporting is a matter of how you format the data, on individual lines. And a setting which indicates how it's displayed, separate or combined.

1 -

If and when we are able to include splits in Reminders, I would like those Reminder splits to show up in the appropriate sections of the Spending Plan. For example, if I have a split Reminder for a paycheck showing:

- Income=$+1000

- Insurance=$-100

I would like those splits to show up Spending Plan like this:

- Spending Plan | Income — $+1000 (the Income)

- Spending Plan | Bills — $-100 (the Insurance payment)

In other words, I would also like to have a recurring split Reminder show up as separate reminders for purposes of the Spending Plan — before the actual transaction for that Reminder comes in.

(NOTE: This is slightly different from having split Transactions treated as separate transactions.)

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)1 -

This may have been covered here, but another reason to split into separate transactions is that you cannot attribute a split to a Bill.

For instance, I have a Bill that is paid through an Apple account. This month, there were other purchases so the bill from Apple came as a combined dollar amount. I split the transaction to reflect proper categories but cannot LINK the one Bill to my Spending Plan.

0 -

Hello everyone,

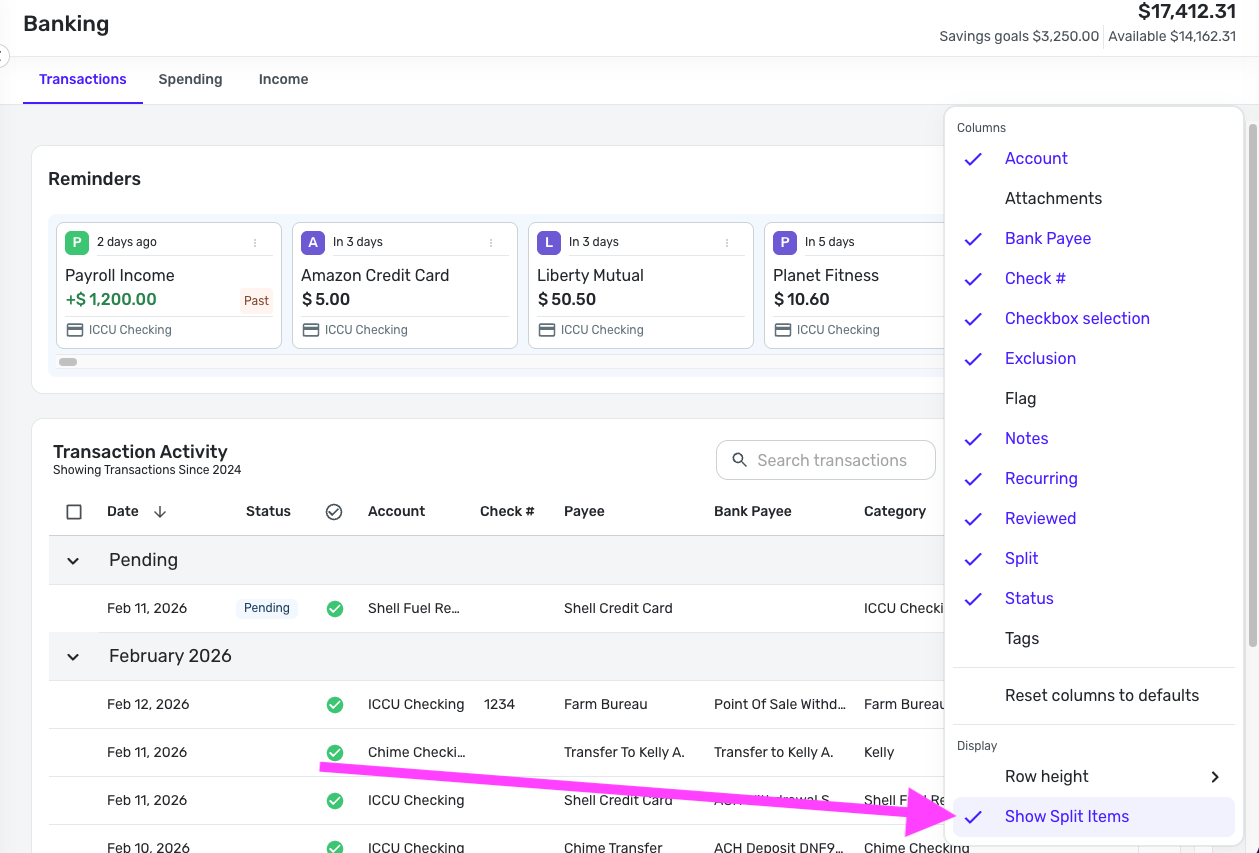

The new Transactions List includes a "Show Split Items" option that displays splits as individual transactions. This is located in the gear icon at the top of account registers:

If this new feature doesn't meet any of the use cases outlined in this request, we will ask that separate requests be created for each item still needed for split lines. This will allow our product team to gauge how many users would like to see each specific change made. Here are the existing requests I was able to find:

Thank you!

-Coach Natalie

1 -

I’m really excited about the ability to treat split transactions as different line item. That’s a great step forward.

However, the update is still treating split transactions as one single transactions. For example, I have a transaction where one portion should not be part of the spending plan. But even when I click “exclude” for only one part of the split, it automatically applies it to the entire transaction, including the portion I’m trying to exclude.

It would be much better if split transactions were treated as individual items rather than remaining tied together as one. That would allow each split item to have its own name, notes, and settings, even though they originated from one transaction.

For example, sometimes I split a transaction so I can link part of it to a recurring bill. Right now, that is not working correctly because the system still treats the split as one transaction, even when I try to select only one portion to link to the recurring bill.

0 -

-Coach Natalie

1